41+ what is an origination fee on a mortgage

Web A mortgage origination fee is any fee that adds to the profit a lender can make on a loan. For example a 1 origination fee on a 300000 mortgage would result in an additional cost of 3000 on top of your loan.

Loan Origination Fees More Painful Than Interest Good Financial Cents

Itll typically cost you between 05 and 1 of the total loan.

. Web Origination fees are costs that a lender charges in order to establish your mortgage. Loan B has no origination fee but comes with an APR of 1199. Web A mortgage origination fee is a fee charged by the lender in exchange for processing a loan.

So for example if you took out a home loan worth 300000 you may pay 1500 to 4500 in origination fees. Lets take a closer look. The origination fee may include processing the application underwriting and funding the loan and other administrative services.

Web Loan A charges a 2 origination fee and has a 999 APR. Web The mortgage origination fee is a one-time fee that lenders charge to help cover the cost of processing and holding the loan. Thats why its important to shop.

It is typically between 05 and 1 of the total loan amount. Youll also see other origination charges on your Loan Estimate and Closing Disclosure if there are prepaid interest points associated with getting a particular interest rate. Web An origination fee is what a lender charges in order to set up the loan.

The origination fee generally ranges from 05 or 1 of the loan amount but it can change depending on the bank and. In that case you probably wouldnt spend more 4000 on the origination fee. Lets say you take out a 400000 mortgage to buy a new house.

Web The origination fee on a mortgage is typically 05 percent to 1 percent of the amount youre borrowing. Web Mortgage origination fees are generally 05 to 1 of the value of the loan. For others this is one fee.

Web Origination fees usually average between 05 and 15 of your overall loan amount. If you have a competitive buyer profile or a lender is particularly eager to win your business you might be able. Both loans have five-year repayment terms.

Origination fees generally can only increase under certain circumstances. Web A loan origination fee is not a single fee but actually a set of lender-specific fees that are part of your costs when closing a mortgage loan. Web For a mortgage origination fees are typically 05 to 1 of the loan amount.

Web An origination fee is what the lender charges the borrower for making the mortgage loan. Though 1 of anything seems small the amount it represents in the context of your mortgage loan is indeed significant. They are part of your loan closing costs as a home buyer and are designed to cover the many administrative.

For instance a 400000 home loan could have a fee ranging from 2000 to 4000 fees. Loan origination fees are quoted as. Web A mortgage origination fee is an upfront fee charged by a lender to process a new loan application.

Web Origination fees usually reflect a fairly small percentage of the loan amount. Some lenders split this into a processing fee the cost of taking your application and gathering documentation and an underwriting fee the cost to have someone look at your application and determine if you qualify. Mortgage lenders are going to charge fees one way or another.

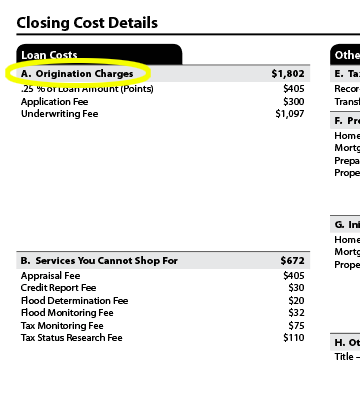

As of 2019 the average origination fee for a mortgage for a single-family home was. Web In the example above the loan origination charge is 1840 on a 348000 loan amount which makes the fee roughly half a percentage point 50. Avoiding and Lowering a Mortgage Origination Fee.

Web The high cost of origination fees. Loan estimate and closing disclosure. Some factors that can determine the size of your fee.

This particular broker charged a 250 origination charge a 695 processing fee and an 895 underwriting fee which combined make up the 1840 total. Web Loan origination fees are usually a percentage of the total loan amount. Your origination fee may also include discount points which are a way to prepay interest on your home loan as a way to save money in the long run.

The fee is compensation for executing the loan. They usually fall between 05 and 1 of a borrowers mortgage. On average expect to pay 05-10 of your loans principal to cover your mortgage origination charge.

Web If the lender is charging one point 1 the fee would rise to 2000. Web Though fees vary by lender based on many factors theyre typically about 05 to 15 of the amount youre borrowing. Loan A has a 5000.

Web Generally origination fees are 05 to 1 of the total loan amount though there are some lenders that offer mortgages with no origination fee.

Mortgage Origination Fees What You Need To Know Smartasset

Loan Origination Fee Origination Fee Definition More Guaranteed Rate

Mortgage Origination Fee The Inside Scoop Rocket Mortgage

Origination Fee Definition Average Cost And Ways To Save

![]()

Origination Fee Definition Average Cost And Ways To Save

What Is Loan Origination And Its Fees Moneytips

What Is A Loan Origination Fee Mortgages And Advice U S News

What Is A Mortgage Origination Fee Nerdwallet

Free 10 Settlement Statement Samples Mortgage Conference Real Estate

What Is A Mortgage Origination Fee And Do I Have To Pay It Fox Business

G210481mm03i001 Gif

Business Credit Building

Free 10 Settlement Statement Samples Mortgage Conference Real Estate

5 Helpful Tips For Viewing Estimates And Comparing Lenders Loan Cabin

Mortgages Handling High Closing Costs The New York Times

Understanding Closing Costs Sirva Mortgage

What Is An Origination Fee Consumeraffairs